(Bloomberg) — U.S. futures dropped with European stocks as the highest oil prices since 2014 stirred fears that a spreading energy crunch will derail the global pandemic recovery.

Most Read from Bloomberg

West Texas Intermediate crude rose past $80 a barrel and China’s coal futures reached a record as flooding shuttered mines. Aluminum rose to the highest since July 2008, leading broad gains among base metals. Contracts on the tech-heavy Nasdaq 100 underperformed those on the S&P 500.

Fuel shortages in China and Europe bolster the case that higher inflation will persist beyond the expectations of central bankers, pushing them toward faster rate increases to curb price pressures. Inflation data due Wednesday are expected to show price pressures remained elevated last month.

“We see rising risks to global growth and evidence of more persistent inflation, which makes us more cautious on the outlook for global markets overall,” Salman Ahmed, global head of macro and strategic asset allocation at Fidelity International, wrote in a note to clients.

Upcoming reports on third-quarter company profits are seen as the next potential pressure point in a market already under siege from slowing global growth, sticky inflation and tighter monetary policies.

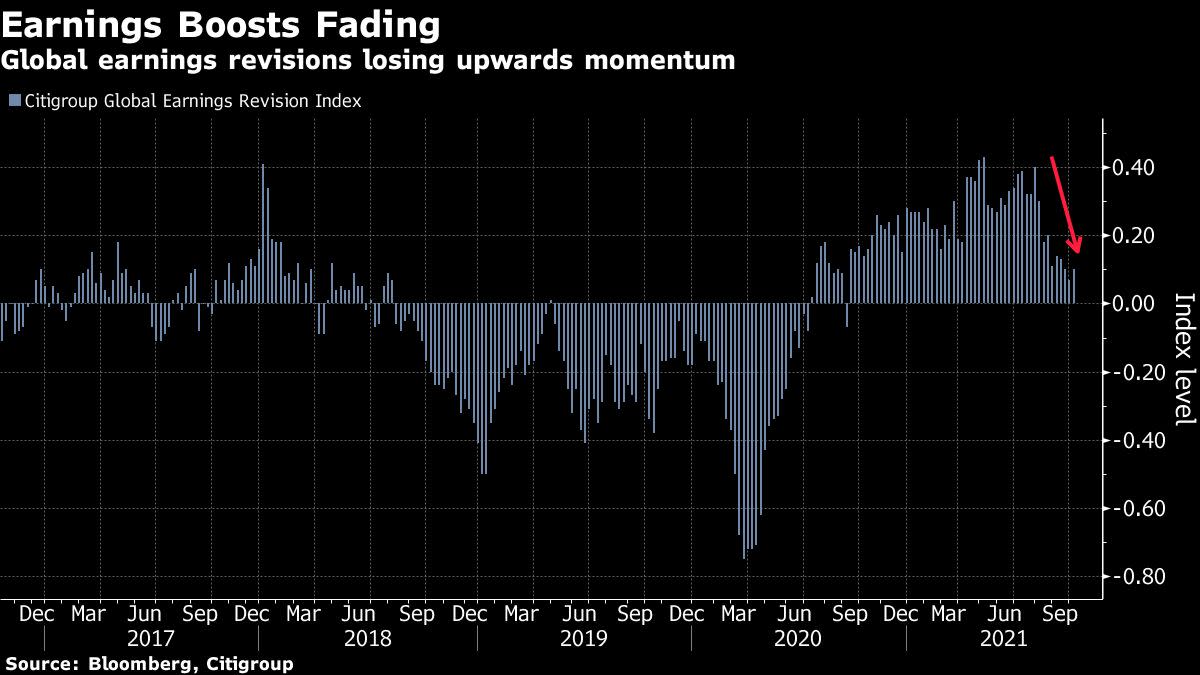

Global earnings revisions are sliding — an omen for U.S. stocks that have taken their cue from rising earnings estimates all year.

“The coming earnings’ season in the U.S. will be heavily scrutinized for pricing power, margins and clues on the shortage situation, as well as wage pressures,” according to Geraldine Sundstrom, a portfolio manager at Pacific Investment Management Co. in London. “Already a number of large multinationals have issued warnings about production cuts and downgraded their Q3 outlook due to supply chain and labor shortages.”

Any retreat in U.S. stocks presents an opportunity to “buy the dip,” according to strategists at some of Wall Street’s biggest banks who argued inflation fears are overblown.

Read more: Goldman and JPMorgan Say Buy the Dip as Inflation Seen Temporary

Meanwhile, Treasury futures fell after the 10-year 10-year benchmark advanced past 1.6% Friday. There’s no cash Treasuries trading Monday due to a U.S. holiday. The dollar was lower against most Group of 10 peers.

Elsewhere, declines in European equities led by travel and technology companies.

A gauge of Chinese tech equities jumped about 3% on easing concerns about Beijing’s crackdown on internet platforms, after food delivery giant Meituan received a lower-than-expected antitrust fine.

In cryptocurrencies, Bitcoin climbed past $56,000.

Here are a few events to watch this week:

-

IMF/World Bank annual meetings start in Washington. Though Oct. 17

-

Bank of Korea policy decision and briefing. Tuesday

-

Atlanta Fed President Raphael Bostic speaks on inflation. Tuesday

-

U.S. FOMC minutes and CPI. Wednesday

-

JPMorgan Chase & Co. kicks off the reporting season. Wednesday

-

China PPI, CPI. Thursday

-

U.S. initial jobless claims, PPI. Thursday

For more market analysis, read our MLIV blog.

Some of the main moves in markets:

Stocks

-

Futures on the S&P 500 fell 0.4% as of 8:31 a.m. New York time

-

Futures on the Nasdaq 100 fell 0.7%

-

Futures on the Dow Jones Industrial Average fell 0.2%

-

The Stoxx Europe 600 fell 0.4%

-

The MSCI World index was little changed

Currencies

-

The Bloomberg Dollar Spot Index rose 0.1%

-

The euro was unchanged at $1.1569

-

The British pound rose 0.1% to $1.3634

-

The Japanese yen fell 0.7% to 113.08 per dollar

Bonds

Commodities

Most Read from Bloomberg Businessweek

©2021 Bloomberg L.P.

from WordPress https://ift.tt/3uZfetn

via IFTTT

No comments:

Post a Comment