(Bloomberg) — Asian stocks climbed Thursday as traders took the latest Federal Reserve comments about the prospect of tapering stimulus in their stride. Treasuries yields held a decline.

Shares rose in Japan, Australia and South Korea. U.S. contracts advanced after the S&P 500 and Nasdaq 100 posted a modest increase. Philadelphia Fed President Patrick Harker said it’s appropriate “to slowly, carefully move back” on bond purchases at the appropriate time. Ten-year U.S. Treasury yields dipped below 1.60%.

Investors are also digesting President Joe Biden’s plans to amend a U.S. ban on investments in companies linked to China’s military, and looking ahead to Friday’s U.S. jobs report for the latest insight into the rebound from the pandemic and inflation risks.

Oil retained gains on the prospect of a recovery in demand, a rally that’s bolstered commodity-linked currencies like the Canadian dollar and the Norwegian krone. Bitcoin traded at about $37,500, maintaining its advance this week after May’s cryptocurrency rout.

Markets are grappling with a range of cross-currents, including the risk that inflation could prove sticky, the prospect of a gradual reduction in emergency stimulus and speculative fervor emerging again in so-called meme stocks like AMC Entertainment Holdings Inc. Global equities, meanwhile, are hovering at record levels after a powerful rally from pandemic lows.

“It seems like they’re starting to lay the ground work for tapering,” Aaron Clark, portfolio manager at GW&K Investment Management, said of the Fed’s recent signaling. “So I think investors are just in a holding pattern right now.”

Fed officials have also repeatedly said price pressures are likely transient and that policy makers will nurture the reopening from the health crisis. BlackRock Inc. Chief Executive Officer Larry Fink said the potential for a spike in inflation may be underestimated.

The Fed’s Beige Book indicated the pace of the U.S. recovery picked up somewhat in the past two months, sparking price pressures as businesses contended with worker scarcity and rising costs.

Meanwhile, the Fed said it plans to begin gradually selling a portfolio of corporate debt purchased through an emergency lending facility launched last year, as the Covid-19 pandemic was spreading panic through financial markets.

Here are key events to watch this week:

U.S. employment report for May on Friday

These are some of the main moves in markets:

Stocks

S&P 500 futures rose 0.1% as of 9:26 a.m. in Tokyo. The index rose 0.1%Nasdaq 100 contracts added 0.2%. The index climbed 0.2%Japan’s Topix index increased 0.9%Australia’s S&P/ASX 200 index was up 0.6%South Korea’s Kospi index rose 0.5%Hang Seng Index futures rose 0.1% earlier

Currencies

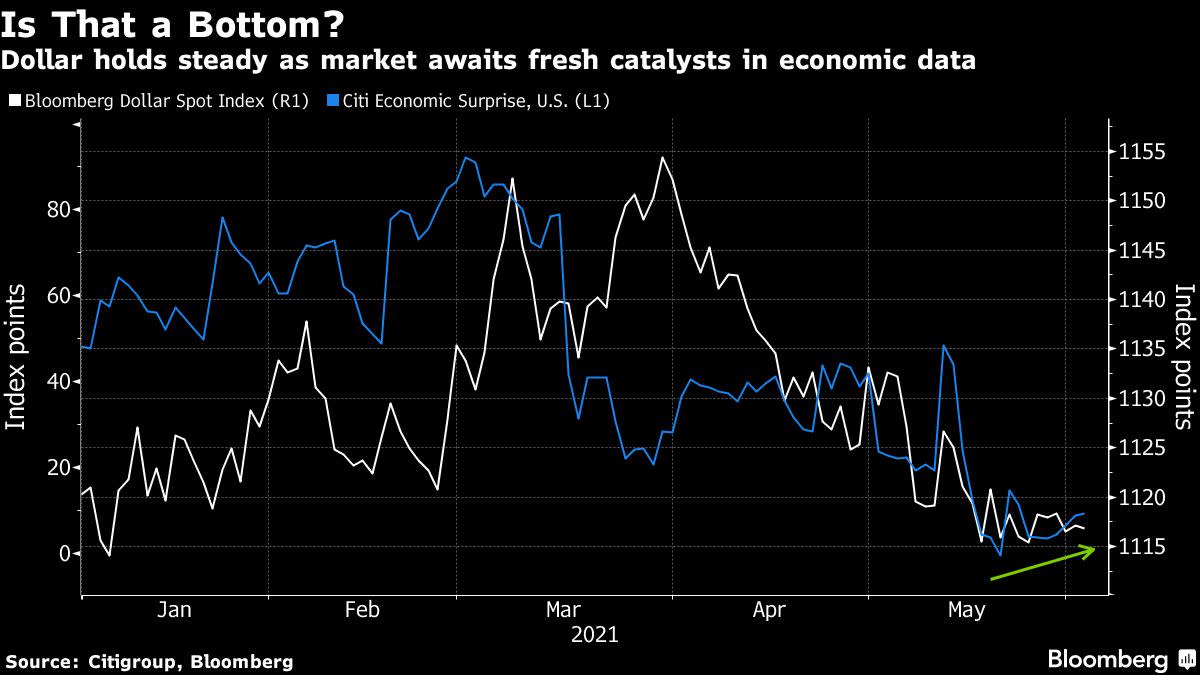

The Bloomberg Dollar Spot Index was little changedThe euro was at $1.2211The Japanese yen was at 109.64 per dollarThe offshore yuan was at 6.3832 per dollar

Bonds

The yield on 10-year Treasuries held at 1.59%Australia’s 10-year bond yield fell three basis points to 1.65%

Commodities

West Texas Intermediate crude was at $68.84 a barrelGold was at $1,907.56 an ounce

More stories like this are available on bloomberg.com

Subscribe now to stay ahead with the most trusted business news source.

©2021 Bloomberg L.P.

from WordPress https://ift.tt/3fMmwuA

via IFTTT

No comments:

Post a Comment